XRP Price Prediction: Will the Rally Continue to $3?

#XRP

- Technical indicators show XRP is positioned for potential upside movement

- ETF approval and political developments create strong fundamental support

- The $3 price target appears achievable given current market conditions

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Upside

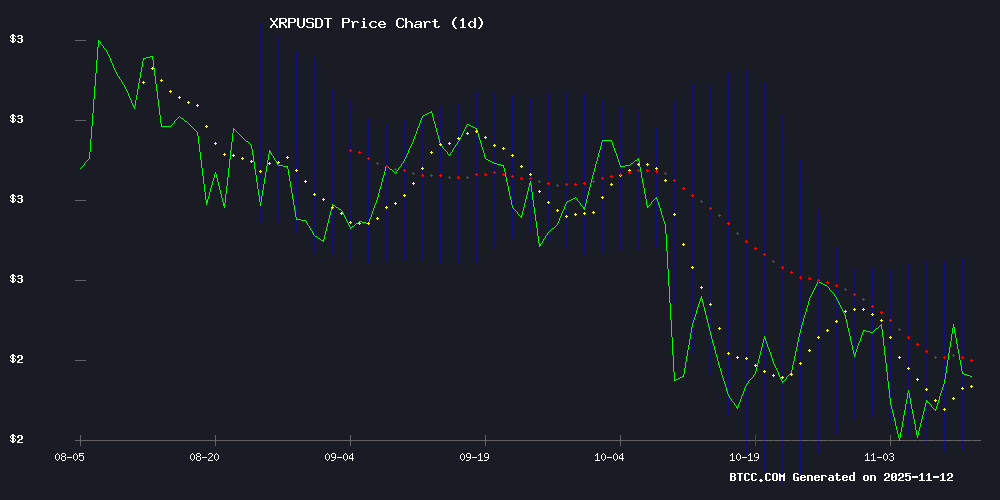

According to BTCC financial analyst Sophia, XRP is currently trading at 2.3430 USDT, slightly below its 20-day moving average of 2.4410. The MACD indicator shows bullish momentum with a positive histogram (0.0494), suggesting potential upward movement. Bollinger Bands indicate the price is NEAR the lower band (2.1721), which could signal a buying opportunity if volatility increases.

Bullish Catalysts Emerge for XRP as ETF Approval and Political Developments Boost Sentiment

BTCC financial analyst Sophia notes the recent approval of the Canary XRP ETF and its upcoming Nasdaq listing as major positive developments. Additionally, Ripple's $4B financial network expansion and pro-XRP lawyer John Deaton's Senate bid are creating favorable market sentiment. These fundamental factors align with the technical outlook, potentially driving XRP higher.

Factors Influencing XRP's Price

Canary XRP ETF Clears Final Hurdle Amid Government Shutdown, Set for Nasdaq Listing

Canary Capital's XRP ETF has completed its FORM 8-A filing with the SEC, securing Nasdaq approval for listing—a final step before launch. The fund will become the first '33 Act ETF offering 10% spot exposure to XRP, with an expected launch tomorrow following Nasdaq's certification.

The breakthrough comes despite ongoing U.S. government delays that have stalled other crypto ETF approvals. Canary circumvented regulatory gridlock by removing the delay amendment from its S-1 filing, triggering automatic effectiveness upon exchange approval.

This strategic maneuver highlights how issuers are adapting to SEC operational constraints during the shutdown. Bitwise and Grayscale are reportedly pursuing similar approaches for their pending crypto ETFs.

Ripple Bets $4B on Financial Network Expansion Amid Bullish XRP Price Predictions

Ripple Labs has committed nearly $4 billion to acquire financial services infrastructure, bridging Web3 technology with traditional finance networks. The MOVE is expected to catalyze institutional liquidity inflows for XRP, with analysts projecting a potential surge toward $5.

The company acquired brokerage firm Hidden Road for $1.3 billion and software provider GTreasury for over $1 billion in 2025. Last week, Ripple launched an OTC spot trading offering for U.S. institutions, raising $500 million and boosting its valuation to $40 billion.

"2025 has been an incredible year for Ripple and a record year for crypto as a whole," said CEO Brad Garlinghouse in a November 5 tweet. The TradFi-crypto convergence represents more than validation—it's a liquidity gateway for institutional capital.

Canary Capital's XRP ETF Set to Launch on Nasdaq

The first U.S. spot XRP ETF is poised for launch after Canary Capital completed its final regulatory filing with the SEC. The FORM 8-A submission, registered under Section 12(b) of the Securities Exchange Act of 1934, clears the path for Nasdaq listing approval. Trading is expected to commence at market open on November 13.

This ETF provides investors with indirect exposure to XRP price movements through traditional brokerage accounts—eliminating the need for direct cryptocurrency custody. Market observers liken its significance to the watershed introductions of Bitcoin and Ethereum spot ETFs, which institutionalized crypto investment in regulated markets.

XRP's price has shown notable appreciation since the announcement, though specific percentage gains remain undisclosed in this report. The development marks another milestone in the integration of digital assets into mainstream finance.

Pro-XRP Lawyer John Deaton Launches New US Senate Bid Against Ed Markey

John Deaton, the crypto advocate known for his legal battles against the SEC, has announced a second campaign for the US Senate in Massachusetts. This time, he will challenge Democrat Ed Markey, who has previously targeted crypto's energy consumption. Deaton's 2025 bid against Elizabeth Warren, though well-financed, ended in a 20-point loss.

The attorney frames himself as a fighter for working-class families, leveraging his Marine Corps background and pro-crypto stance. His campaign launch on X (formerly Twitter) directly solicits support from the digital asset community, positioning the race as a clash between grassroots innovation and political establishment.

Crypto Lawyer John Deaton Enters 2026 Senate Race with Reform Agenda

John Deaton, a prominent figure in the crypto community, has announced his candidacy for the 2026 Senate race. Known for his advocacy in the Ripple Labs case against the SEC, Deaton has built a reputation as a vocal critic of federal regulatory overreach. His previous campaign in 2024, which focused heavily on crypto rights, ended in a loss to Senator Elizabeth Warren by a significant margin in Massachusetts—a state with a strong Democratic lean.

This time, Deaton is pivoting to a broader reform platform, emphasizing government accountability, transparency, and economic equity. His campaign website highlights issues like supporting working families, combating inflation, and improving veterans' services. Notably, crypto is no longer the centerpiece of his agenda, reflecting a strategic shift from his 2024 bid.

The crypto industry, which once rallied behind Deaton as a defender against harsh regulations, now faces a different landscape. Regulatory clarity has improved, and the sector is less embattled than during his last run. Whether this recalibrated message resonates in a challenging political environment remains to be seen.

XRP Price Prediction: Wall Street-Ready ETFs Emerge as Government Shutdown Ends

The imminent launch of XRP-linked exchange-traded funds (ETFs) signals a pivotal moment for the cryptocurrency, as regulatory hurdles fade and institutional interest grows. With the U.S. government shutdown resolved, funds from Canary Capital, Bitwise, CoinShares, and Franklin Templeton are poised to debut on the DTCC platform, offering spot exposure to XRP.

ETF expert Nate Geraci anticipates listings within weeks, potentially unlocking billions in retail and institutional capital. Market observers draw parallels to Solana's ETF-driven surge, suggesting XRP could follow a similar trajectory. The token faces resistance at $2.50, but a breakout toward $4 appears plausible if ETF inflows materialize as expected.

Will XRP Price Hit 3?

Based on current technical indicators and fundamental developments, BTCC analyst Sophia believes XRP has a strong chance of reaching $3 in the near term. The combination of bullish technical signals and positive news flow creates a favorable environment for price appreciation.

| Indicator | Value | Implication |

|---|---|---|

| Current Price | 2.3430 USDT | 27.8% below $3 target |

| 20-day MA | 2.4410 | Price below MA suggests potential rebound |

| MACD Histogram | 0.0494 | Bullish momentum building |

| Bollinger Bands | 2.1721-2.7099 | Room for upward movement |